We can look at this as a chess game, grandmaster level, with high net-worth investors as the chess pieces. It’s not just about considerable sums of money but also how these resources can be built on for a lifetime. High-net-worth individuals (HNWIs) have $1 million or more in personal worth, excluding their primary residence.

This guide will look at the strategies and insights that can assist high-net-worth individuals in growing their wealth sustainably while managing the associated risks. From critical investment approaches and strategies to important tax planning tips and techniques of portfolio diversification, we will explore everything that makes all the difference in terms of maximizing returns. Whether you are new to high-net-worth investing or want to refine your current strategies, this article will equip you with the knowledge and tools that can propel you to a whole new level in your financial game.

Are you ready to learn the unique, behind-the-scenes secrets to high-net-worth investing? Let’s get started!

Table of Contents

- Best Investments for High Net Worth Investors

- Defining HNWIs

- Understanding High-Net-Worth Individuals (HNWIs)

- Privileges and Advantages of High-Net-Worth Individuals

- Types of High-Net-Worth Individuals

- What Benefits Do HNWIs Get?

Best Investments for High Net Worth Investors

High-net-worth individuals (HNWIs) tend to seek investment strategies that combine long-term stability with opportunities for significant growth. While some may favor conservative, income-generating instruments, others expand into less conventional or less liquid vehicles to diversify holdings and pursue higher returns.

While often perceived as pursuing luxury or exclusivity, most HNWIs approach investing with discipline and pragmatism. Their portfolios frequently include both traditional assets, such as equities and mutual funds, and alternative investments like private equity, real estate, and venture capital.

A HNWI is typically defined as someone with more than $1 million in investable assets, excluding their primary residence. Many individuals may reach this level through consistent retirement contributions, strategic saving, and disciplined investment practices. Once this threshold is met, the investment focus often shifts toward preserving wealth, managing risk, and optimizing for long-term outcomes, including estate planning and tax efficiency.

Because immediate liquidity is often not a constraint, HNWIs are well-positioned to allocate a portion of their capital to long-horizon opportunities. Many qualify as accredited investors, which provides access to private market investments and exclusive opportunities that are not registered for public trading. These might include hedge funds, private equity, and alternative real assets—all of which offer distinct risk/return profiles.

Among the asset classes commonly explored by high-net-worth investors are:

Private Equity

Private equity allows investors to diversify beyond public markets by investing directly in private companies or through pooled private equity funds. This strategy may include acquiring ownership stakes in established businesses or participating in buyouts, turnarounds, and growth-stage ventures.

In the United States, historical returns from private equity have often exceeded those of public equity markets. For example, data from Cambridge Associates shows that private equity, over a 30-year period ending in 2019, outperformed the S&P 500 by approximately five percentage points annually. However, these returns come with added complexity, limited liquidity, and proprietary performance reporting, making due diligence essential.

Two common approaches include:

- Direct Investments: HNWIs invest in private businesses and may engage in operational decision-making or board-level oversight.

- Private Equity Funds: Capital is pooled with other investors and professionally managed across a portfolio of private companies, reducing concentration risk and providing access to a broader range of deals.

Private equity remains a compelling option for investors seeking differentiated returns and access to companies beyond the reach of public markets. As part of a broader strategy within high-net-worth wealth management, it can enhance both diversification and return potential when thoughtfully integrated into a portfolio.

Private Infrastructure

Private infrastructure investment involves allocating capital to essential public utilities and foundational systems such as toll roads, water treatment facilities, fiber optic networks, airports, and power grids. Often categorized as infrastructure private equity, this asset class appeals to high-net-worth individuals (HNWIs) due to its potential for steady, inflation-linked returns and long-term stability.

These investments are not only financially attractive but also aligned with broader objectives, such as sustainability, clean energy transitions, and public utility enhancement, making them particularly compelling for HNWIs seeking to generate returns while contributing to socially and environmentally beneficial outcomes.

Several investment structures allow access to private infrastructure:

- Private Closed-End Funds: These funds typically raise capital for a set period and return proceeds to investors once underlying assets are divested or mature. They are suited for long-duration projects requiring patient capital.

- Direct Deals: In this model, investors directly participate in infrastructure projects or companies, offering greater control and influence over strategy and outcomes.

- Listed Infrastructure Funds: These publicly traded vehicles provide exposure to diversified infrastructure portfolios with added liquidity and ease of access for investors preferring more flexible entry and exit options.

- Open-End Funds: Without a fixed term, these funds raise capital on an ongoing basis and offer broad portfolio diversification, adapting continuously to market developments.

While infrastructure investments may involve longer holding periods and may not match the high return potential of traditional private equity, they remain valuable within a high-net-worth wealth management strategy. The combination of reliable income streams, reduced volatility, and positive societal impact resonates with investors aiming to balance performance with purpose.. This aligns well with the investment objectives of HNWIs, who are conscious of their broader impact on society and the environment.

Private Credit

Private credit refers to non-bank lending where companies secure customized loans directly from institutional or private investors outside of traditional bank or public bond markets. This form of financing offers more flexibility, faster execution, and greater confidentiality—qualities that often appeal to high-net-worth individuals (HNWIs) seeking higher-yield opportunities and portfolio diversification beyond conventional fixed-income securities.

Private credit structures typically fall into two categories: secured and unsecured.

Secured private credit involves loans backed by tangible or intangible collateral, reducing lender risk and often resulting in more favorable interest rates. Eligible forms of collateral may include commercial or residential real estate, railcars and locomotives in the transportation sector, business equipment, and even aircraft. In trade finance, receivables from clients can serve as security. The liquidity and valuation of the collateral play a key role in determining loan terms, especially the loan-to-value (LTV) ratio. If a borrower defaults, the lender may recover the asset and liquidate it to recoup the outstanding debt.

Unsecured private credit, by contrast, does not require pledged collateral. Instead, lenders assess the borrower’s creditworthiness based on factors such as financial history, income consistency, and overall debt load. Because of the increased risk, unsecured loans typically carry higher interest rates. These types of loans are often extended to established companies with strong credit profiles or to HNWIs who meet high standards of financial stability.

Many unsecured loan agreements also include covenants—contractual obligations that require borrowers to maintain certain financial metrics, such as specific debt ratios or dividend limitations. While these loans provide greater flexibility to borrowers, lenders maintain the right to pursue legal remedies in the event of default, including wage garnishment or property liens. Private credit can be accessed directly by individual investors or through pooled private credit funds, which spread exposure across multiple borrowers. Though private credit investments are relatively illiquid and may carry variable rates, they remain a compelling asset class for sophisticated investors seeking yield enhancement and risk-adjusted returns within a broader wealth management strategy.

Commercial Real Estate

Commercial real estate remains a favored alternative investment among high-net-worth individuals due to its broad scope, inflation resilience, and income-generating potential. This asset class includes residential complexes, office buildings, retail centers, gas stations, and storage facilities. For investors seeking tax deferral options, tools like 1031 exchanges can be leveraged to postpone capital gains taxes upon the sale of investment properties.

Because effective property oversight requires expertise in tenant relations, maintenance, and local zoning considerations, HNWIs often engage third-party property management firms. This allows investors to focus on portfolio-level decisions while delegating daily operational responsibilities.

Commercial real estate includes:

Apartments, particularly multi-family buildings, are valued for their consistent rental income and risk-mitigating tenant diversity. These assets tend to perform well in high-growth or urban renewal zones, where housing demand remains steady. However, operational intensity can be high due to ongoing tenant management and maintenance requirements, which may impact net returns.

Shopping centers and office buildings typically offer long-term leases and reliable tenants, providing stable cash flow. Anchored retail tenants attract foot traffic that benefits adjacent stores, while established corporate tenants in office buildings support occupancy stability. Nonetheless, performance is influenced by changing consumer behavior, remote work trends, and local market conditions. Proactive property management—including lease negotiation, amenity upgrades, and tenant retention strategies—is key to maximizing long-term value.

Storage facilities are favored for their relatively low management demands, predictable income, and adaptability to short-term lease structures. These properties often require minimal upkeep and offer higher cap rates, making them an efficient way to earn consistent revenue with reduced overhead. The ability to adjust rental prices quickly based on market demand adds further appeal.

Gas stations, particularly those with complementary businesses like convenience stores or car washes, provide diversified income and stable demand. Many operate under triple-net leases, shifting operational expenses to tenants and reducing ownership burdens. Site selection plays a critical role in performance; stations located near highways, high-traffic zones, or dense residential areas are positioned to achieve stronger long-term returns.

For those seeking exposure without direct ownership, real estate investment trusts (REITs) offer a more passive route. Publicly traded REIT ETFs provide liquidity and broad market exposure, while private REITs like Fundrise cater to investors seeking customized property portfolios with the potential for higher yield. Both options enable participation in the commercial real estate market with varying levels of risk and involvement.

Government Bonds

Municipal bond funds are a common choice among high-net-worth individuals (HNWIs), particularly after they’ve maximized other tax-advantaged investment opportunities. These bonds often provide federal tax exemption, and when issued by the investor’s state of residence, they can also yield state and local tax benefits.

Critical features of government bonds include:

Municipal Bonds

Municipal bonds are debt securities issued by local authorities and public agencies to fund large-scale public projects such as school construction, infrastructure restoration, and healthcare facilities. These are considered among the safest forms of government bonds, with historically low default rates.

There are two primary types of municipal bonds. General obligation (GO) bonds are backed by the issuer’s taxing power and are considered the most secure. If the issuer cannot meet its payment obligations, the local tax authority is obligated to cover the shortfall. Revenue bonds, on the other hand, are supported by income from specific projects, such as utilities, transportation systems, or toll facilities. While revenue bonds may carry slightly more risk than GO bonds, both are categorized as low-risk assets suitable for long-term capital preservation.

Municipal bonds are typically used to finance projects like:

- Infrastructure development (roads, bridges)

- Education (schools, universities)

- Healthcare (hospitals, clinics)

- Utilities (water, sewage systems)

- U.S. Treasury Securities

U.S. Treasury Securities

Treasury securities remain one of the safest investment options available, backed by the full faith and credit of the U.S. government. These instruments are particularly useful for HNWIs seeking capital preservation, predictable income, and inflation protection.

Treasury bills (T-Bills) are short-term instruments that mature in one year or less and are sold at a discount. Treasury notes (T-Notes) offer intermediate maturities ranging from two to ten years, while Treasury bonds (T-Bonds) are long-term securities with 20- or 30-year maturities. All pay interest semiannually. Treasury Inflation-Protected Securities (TIPS) adjust the principal based on the Consumer Price Index, making them particularly valuable in times of inflation. I-Bonds, another inflation-linked option, offer tax-deferral benefits and can be tax-free if used for qualified education expenses.

Together, municipal and U.S. Treasury bonds offer a range of benefits, from tax efficiency and income stability to capital preservation, making them essential components of diversified portfolios for high-net-worth investors.

Corporate Bonds

Corporate bonds can offer higher returns than government bonds and remain a staple fixed-income option for high-net-worth investors. While high-yield corporate bonds carry greater risk, they can also provide significant gains. In contrast, investment-grade corporate bonds are often sought for their balance of risk and return.

Key benefits include:

- Liquidity: Corporate bond funds are typically more liquid than private equity, offering easier tradability in public markets.

- Priority Payouts: Bondholders are paid before stockholders in cases of company bankruptcy or restructuring.

- Interest Sensitivity: Although they offer fixed payments, bond values can be affected by interest rate changes and inflation, potentially eroding purchasing power.

Alternative Investments: Exciting or Safe

Although high-net-worth investors often have access to exclusive alternative investments, such as private equity or niche asset classes, these aren’t necessary to achieve strong returns. Investors who do not have the specialized knowledge, network, or appetite for managing complex private market assets can still succeed by sticking to simpler, time-tested strategies.

Building a diversified portfolio that includes dividend-paying stocks, broad-market ETFs such as those tracking the S&P 500, and high-yield savings or money market accounts can deliver strong, stable returns over the long term. For many, the key to sustainable wealth is not complexity, but consistency, and choosing reliable strategies that align with long-term goals can often be more effective than chasing every new opportunity.

Defining HNWIs

A high-net-worth individual (HNWI) is typically defined as someone with investable assets totaling at least $1 million, excluding their primary residence. Financial institutions and private wealth management firms use this classification to identify individuals who require tailored financial planning and specialized wealth advisory services. These individuals often hold a mix of cash, liquid investments like stocks, and other easily transferable assets.

Ultra-high-net-worth individuals (UHNWIs), a subcategory, are defined as those with a net worth exceeding $30 million. While UHNWIs benefit from a broader range of private wealth management services, global economic shifts can affect their portfolios significantly. For example, the global UHNWI population experienced a decline of approximately 3.7% in 2022, reflecting broader market volatility.

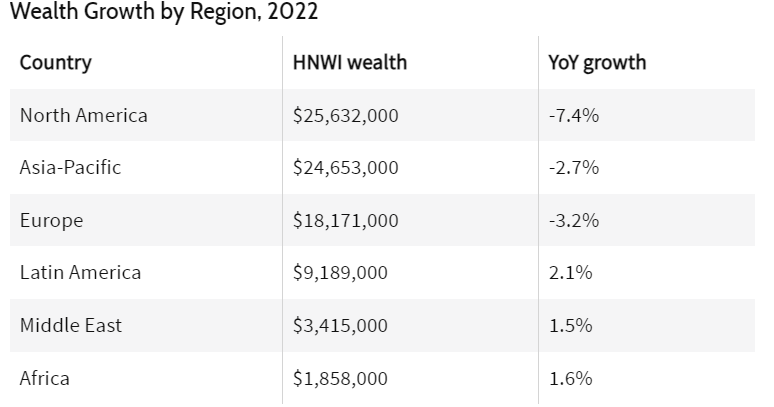

Despite such fluctuations, the number of HNWIs continues to rise. North America, in particular, has seen steady growth, with an estimated 7.4 million individuals now falling into the high-net-worth category. As these numbers increase, so does the demand for personalized wealth advisory services and strategies suited to this financially complex segment.

Understanding High-Net-Worth Individuals (HNWIs)

In the financial industry, individuals are often classified by their net worth, and those with liquid assets of at least $1 million are typically considered high-net-worth individuals (HNWIs). Liquid assets refer to cash or investments that can be quickly converted into cash, such as stocks, bonds, or money market instruments.

Wealth can be accumulated through multiple paths. While many HNWIs build their assets through disciplined saving, strategic investing, and long-term employment or entrepreneurship, others may acquire wealth from events such as selling a business, receiving an inheritance, or collecting life insurance proceeds.

Financial institutions often offer enhanced services to clients with high net worth. These services may include reduced fees, access to exclusive financial products, dedicated wealth advisory services, and invitations to private investment events, though eligibility typically depends on a client’s account size and overall asset profile.

As an individual’s net worth increases, financial needs become more complex. HNWIs often require tailored wealth management strategies that include investment diversification, estate and tax planning, and access to private investment opportunities such as initial public offerings (IPOs) or early-stage companies.

Special Considerations

In 2022, North America reported approximately 7 million HNWIs, with the region experiencing the highest pricing levels globally. Europe followed closely with 5.6 million individuals in the same category.

Despite global uncertainty, only a 3% decline was reported in the number of ultra-high-net-worth individuals (UHNWIs) worldwide between 2021 and 2022. North America saw the most significant decrease at 6%. Still, the combined wealth of global billionaires reached an estimated $83 trillion.

HNWIs are commonly segmented into three tiers:

- Millionaire Next Door: Individuals with $1 million to $5 million in investable assets

- Middle-Tier Millionaire: Those with $5 million to $30 million

- Ultra-HNWIs: Individuals whose net assets exceed $30 million

In 2022, there were approximately 210,000 ultra-high-net-worth individuals globally—a 4% increase from the previous year. The largest demographic group consisted of those in the “millionaire next door” category.

While definitions can vary slightly between institutions, most do not include illiquid assets like a primary residence, artwork, or collectibles in determining net worth. Instead, the focus remains on assets that are transferable and liquid, forming the basis for wealth advisory services tailored to high-net-worth clients.as the person’s home and artworks and fine objects may be problematic to sell, the principal residence is often not included.

Privileges and Advantages of High-Net-Worth Individuals

High-net-worth individuals (HNWIs) often receive access to enhanced financial services that go beyond standard offerings. These can include lower administrative fees, preferential savings rates, exclusive investment opportunities, and invitations to select financial events.

HNWIs also meet the eligibility criteria for alternative investments, typically restricted to accredited investors. This includes access to hedge funds, private equity, and venture capital funds—vehicles that are not available to the general public. These investment options may include opportunities in private companies, specialized real estate projects, or other assets not commonly accessible through traditional retail investment channels.

The extent of these privileges can vary depending on the financial institution and regional regulations. However, the overall goal is consistent: to provide tailored wealth advisory services that reflect the unique financial profile and investment capabilities of high-net-worth individuals.

Types of High-Net-Worth Individuals

High-net-worth individuals are commonly classified into tiers based on the amount of investable liquid assets they hold. Those with assets between $100,000 and $1 million are often referred to as sub-high-net-worth individuals (sub-HNWIs). Investors with $5 million or more in liquid assets fall into the very-high-net-worth (VHNW) category. Individuals with more than $30 million are classified as ultra-high-net-worth individuals (UHNWIs).

These tiers are based solely on liquid, investable assets and typically exclude non-liquid personal assets such as primary residences, collectibles, and personal property. This distinction allows for a more accurate assessment of an individual’s investment capacity and financial flexibility.

Classifying investors by net worth allows wealth advisory services and private wealth management firms to tailor solutions that align with specific needs. Sub-HNWIs may prioritize growth through diversified portfolios, while VHNWIs and UHNWIs often require estate planning, philanthropic structuring, and access to complex investment strategies.

Each category may access investment opportunities that match their profile:

- Hedge Funds – Available to accredited investors, these offer exposure to actively managed strategies beyond conventional investments.

- Private Equity and Venture Capital – Typically reserved for high-net-worth investors, these opportunities involve private markets and startup funding with higher potential returns.

- Alternative Assets – Investments in real estate, art, or other tangible assets can offer diversification and non-correlated returns.

Understanding these classifications helps investors and their advisors design more effective wealth strategies and access the investment opportunities most aligned with their goals and capacity.

What Benefits Do HNWIs Get?

High-net-worth individuals (HNWIs) often require more sophisticated financial solutions than typical retail investors due to their substantial investable assets and multifaceted financial goals. While standard investors may rely on mutual funds, HNWIs often qualify for separately managed accounts that offer customized investment strategies aligned with personal risk tolerance and objectives.

Beyond portfolio customization, HNWIs benefit from access to specialized wealth advisory services, which may include:

Estate Planning

Estate planning helps ensure that wealth is preserved and efficiently transferred to future generations. For HNWIs, this often involves more complex arrangements such as trusts, cross-border wills, and multi-jurisdictional estate structures, especially when assets are held in multiple countries.

Tax Planning

Given the scale of their wealth, HNWIs face higher tax exposure. Wealth managers work to implement compliant tax strategies that minimize liabilities while maximizing after-tax returns. This may involve charitable giving, strategic asset placement, and the use of legal tax shelters.

Portfolio Management

HNWIs are often eligible for access to private investments unavailable to most investors, including private equity, hedge funds, and real estate projects. Wealth managers structure these portfolios to balance risk and return according to the client’s long-term financial outlook and liquidity needs.

These combined services offer HNWIs a personalized approach to managing and growing wealth. By working with wealth managers who understand the financial and legal complexities of high-net-worth situations, clients gain the advantage of coordinated planning that supports both lifestyle and legacy goals.

Ready to align your wealth strategy with your future?

Frequently Asked Questions

How much would be a comfortable net worth?

Net worth is calculated by subtracting liabilities from total assets. As of 2022, the median net worth of American households is approximately $1,063,700. Net worth tends to vary by age group, ranging from around $183,500 for individuals under 35 to about $1,794,600 for those aged 65 to 74. Interestingly, it often declines among individuals over 75 due to asset drawdowns in retirement.

What defines a high-net-worth investor?

A high-net-worth individual (HNWI) is generally considered someone with at least $1 million in liquid financial assets. Some classifications reference thresholds as low as $250,000 in investable assets (excluding primary residence and pension holdings), while income-based qualifications may start around $100,000 annually, depending on the jurisdiction or institutional criteria.

What estate planning advice do wealthy individuals typically seek?

Estate planning for HNWIs often involves structuring trusts, wills, and family governance frameworks. Advisors assist in reducing estate tax exposure, protecting assets from legal risks, and ensuring wealth is transferred according to the individual’s legacy goals, across generations and sometimes across borders.

How do high-net-worth individuals achieve efficient returns through personalized planning?

Through custom financial planning, HNWIs pursue returns aligned with their specific risk tolerance and financial objectives. Strategies include tax optimization, alternative investments, personalized asset allocation, and targeted use of private markets to generate long-term value.

What is the difference between a financial advisor and a private wealth manager?

A financial advisor typically provides general financial services such as retirement planning and budgeting. In contrast, a private wealth manager specializes in serving high-net-worth clients with services like estate planning, tax strategies, and access to exclusive investment vehicles. Wealth managers generally deliver more tailored, comprehensive support across multiple financial domains.

Do HNWIs often act as angel investors?

Yes, many high-net-worth individuals act as angel investors. Their expertise and liquidity allow them to fund early-stage ventures and contribute strategic insights. These investors often engage closely with founders and help shape the company’s direction in its formative stages.

How much net worth is required to be a billionaire?

A billionaire is defined as someone with a net worth of at least $1 billion. Net worth encompasses total assets—such as equities, businesses, real estate, and cash—minus any liabilities.

Who qualifies for the top 5% of wealth in the U.S.?

According to the most recent data from the Federal Reserve, a net worth of approximately $3.8 million places an individual within the top 5% of American households. This threshold may vary over time due to inflation, asset appreciation, and demographic shifts.

Where do high-net-worth individuals typically keep their money?

The ultra-wealthy tend to diversify their assets across a broad spectrum. On average, residential properties make up 32% of total wealth, followed by equities at 18%, commercial real estate at 14%, and bonds at 12%. This allocation reflects a balance between growth, stability, and liquidity needs.