Worried About Choosing the Right Wealth Management Service?

Unlock the Door to Financial Prosperity — Start Exploring Wealth Management Options with Confidence

PillarWM Finder is an independent, research-based directory that helps individuals, especially those with $500,000 or more in investable assets, explore wealth management services tailored to their financial goals. Whether you’re seeking to protect assets, plan for retirement, or grow your portfolio, our platform provides access to structured directories where you can compare financial professionals based on your needs.

We do not provide financial advice or endorse any specific firms. Instead, we empower you with resources to make informed decisions across four essential areas:

High Net Worth Financial Planning Means Unlocking the Doors to YOUR Financial Prosperity & Serenity

What Is High-Net-Worth Financial Planning?

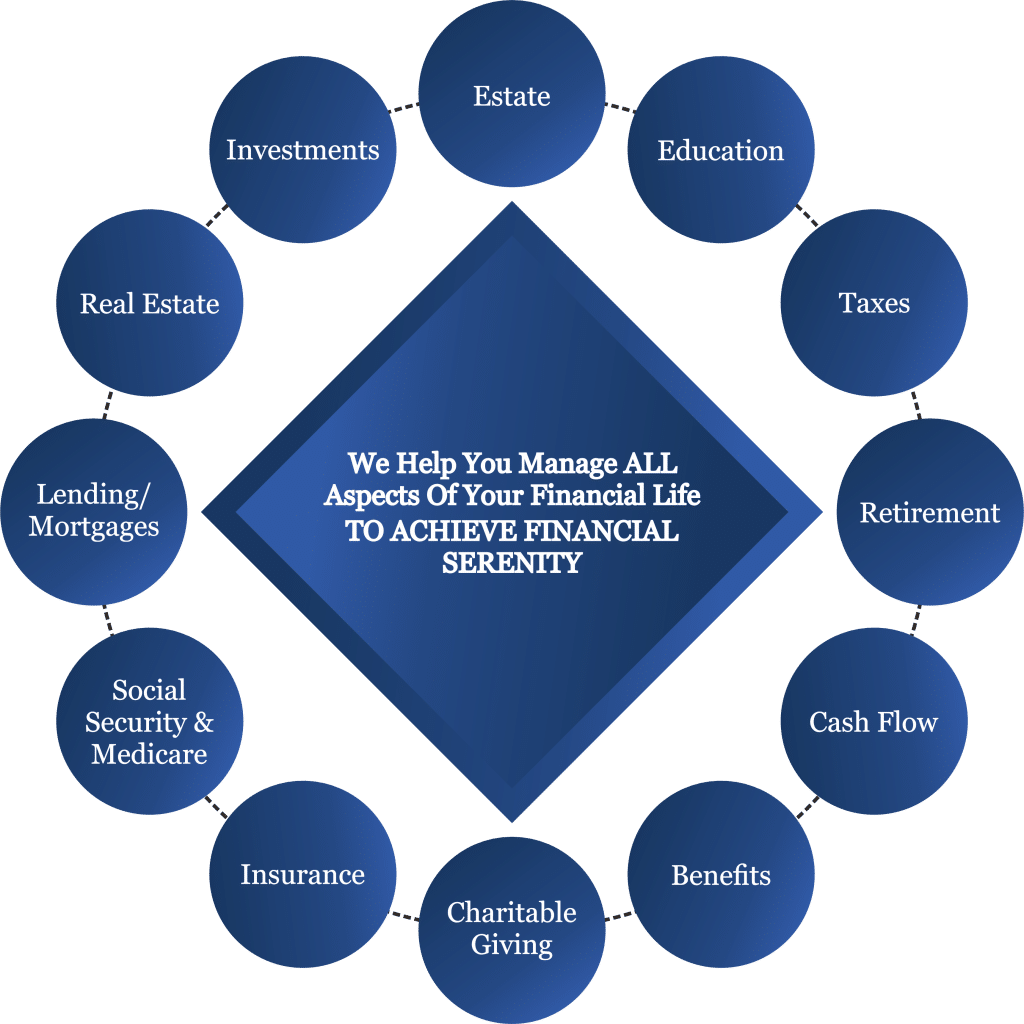

High-net-worth financial planning refers to a specialized approach tailored for individuals or families with significant investable assets, typically $500,000 or more. This planning focuses on strategies that address complex needs such as wealth preservation, tax efficiency, investment diversification, and estate or legacy considerations.

It often involves input from professionals across disciplines—financial advisors, estate planners, tax professionals, and investment managers—working collaboratively to support long-term financial goals. The aim is to build a framework that sustains current financial stability while preparing for future generations.

Unlike general financial planning, high-net-worth strategies consider the greater complexity and unique challenges of managing substantial wealth.

What Is Net Worth in Financial Planning?

In financial planning, “net worth” refers to the total value of an individual’s assets minus their liabilities. For high-net-worth individuals—typically those with $500,000 or more in investable assets—financial planning often involves more advanced strategies to protect and grow wealth.

Professionals may assist with:

While high-net-worth financial planning addresses complex needs, it can also include foundational elements such as budgeting, debt management, and education savings.

Who Needs High-Net-Worth Financial Planning?

High-net-worth financial planning is specifically tailored for individuals or families who have amassed significant wealth and substantial assets. This specialized financial planning service is meticulously crafted to assist them in navigating their intricate financial circumstances, achieving their financial objectives, minimizing tax burdens, and ensuring the effective transfer of their wealth to future generations. It addresses the unique challenges and opportunities that arise when managing substantial assets and catering to the distinctive needs of high-net-worth individuals, including complex estate planning, sophisticated investment strategies, tax optimization, and legacy planning.

In essence, high-net-worth financial planning serves as a customized financial roadmap, guiding affluent clients through the complex landscape of wealth management, with a steadfast commitment to safeguarding and perpetuating their financial legacies.

We Are Different in How We Present Planning & Investing Options – We Call It Goals-Based Wealth Management

Goals-based wealth management is a financial planning approach that centers on aligning investment decisions with your specific life priorities—whether that means retiring early, preserving wealth for future generations, or supporting philanthropic causes.

Rather than focusing solely on market benchmarks, goals-based planning emphasizes personalized objectives such as income stability, risk tolerance, and legacy goals. This method may involve asset allocation, tax-aware strategies, and estate considerations based on individual circumstances.

While PillarWM Finder does not offer advisory services or manage assets, our platform helps individuals explore professionals who offer this type of planning across areas such as:

- Investment management

- Wealth preservation

- Retirement income planning

- Estate and legacy strategies

How to Find a High-Net-Worth Financial Advisor

High-net-worth individuals often face more complex financial considerations than the average investor. When searching for a financial advisor, it’s essential to evaluate your specific goals and seek professionals who are experienced in managing substantial assets and long-term planning.

Here are several factors to consider:

- Look for advisors who specialize in long-term financial planning strategies, including wealth transfer, charitable giving, and multi-generational goals.

- Many individuals prefer working with fee-only financial advisors, as their compensation structure may reduce potential conflicts of interest.

- Compare multiple advisors or firms to evaluate their approach, experience, and client focus.

- Consider professionals familiar with your financial background, mainly if your wealth stems from business ownership, real estate, or other unique paths.

- Ensure that the advisor or team can support broader needs such as cash flow planning, estate organization, and tax-aware strategies.

- Clarify your financial priorities before starting your search so you can match with professionals who align with your vision and service expectations.

PillarWM Finder provides a structured directory to help you begin your search for an advisor who fits your needs.

OUR DIFFERENT AND COMPREHENSIVE

Goals-Based Financial Planning and Investing Help You Enjoy the Lifestyle You Desire and Have Freedom from Worry

Helping you to live life to it’s fullest.

Goals-based financial planning focuses on aligning investment decisions with specific life objectives, such as maintaining your lifestyle, preserving wealth, or supporting future generations. This approach emphasizes clarity, purpose, and long-term focus rather than reacting to market fluctuations or short-term trends.

Instead of relying on guesswork or emotion, goals-based strategies are typically designed using objective financial metrics, such as portfolio performance, income requirements, and defined milestones. These strategies aim to support confidence in reaching goals without unnecessary lifestyle compromises.

While PillarWM Finder does not provide financial advice or manage investments, our directory helps individuals explore professionals who offer this type of planning.

Using Financial Planning Tools to Support Your Long-Term Wealth Strategy

Ongoing wealth planning often includes regularly reviewing your progress toward key financial goals, especially as markets shift or life priorities evolve. A forward-looking strategy can help maintain confidence while minimizing unnecessary financial sacrifice.

Professionals specializing in high-net-worth financial planning may offer periodic evaluations, risk analysis, and adaptive strategies that reflect changing circumstances. This dynamic approach is designed to align future portfolio targets with evolving life objectives.

PillarWM Finder does not offer investment advice or manage portfolios. Instead, our platform helps individuals explore wealth management professionals who may offer these services.

Reducing risk. Inspiring confidence.

WISE INVESTING IS ABOUT BUILDING AND PRESERVING YOUR WEALTH.