As retirement approaches, finding a state that supports long-term financial preservation becomes increasingly important, especially for high-net-worth individuals (HNWIs). Evaluating factors such as income tax, property tax, estate tax, and access to tax-advantaged retirement accounts can help shape a retirement strategy aligned with your goals.

This overview highlights key considerations in selecting a retirement-friendly state, focusing on financial policies and lifestyle factors that may influence long-term investment and estate planning decisions. By understanding each state’s unique tax structure and planning environment, HNWIs can make more informed choices about where to retire with confidence and purpose.

Table of Contents

- The Perfect Place to Retire

- Stating Facts: The Best Places to Retire Rich

- Relocating in Retirement Can Stretch Your Savings in Today’s Economy

- Three Expert Tips for Retirement Planning

- Choosing the Place to Spend Your Retirement: Are You Finally Ready to Decide?

The Perfect Place to Retire

Choosing the ideal state for retirement can be complex, especially for high-net-worth individuals (HNWIs). Personal priorities, family connections, ongoing business interests, lifestyle goals, and existing retirement and health savings plans all play a role in the decision. There is no one-size-fits-all answer—what’s ideal for one person may not work for another.

Every state comes with trade-offs. For instance, the energy and culture of New York may appeal to some retirees, despite higher taxes and living costs. Others may prioritize financial efficiency and lower tax burdens over urban amenities. For HNWIs, effective retirement financial planning often means finding a location that balances lifestyle preferences with strategic tax and investment considerations.

To help narrow down the options, consider these key factors that can shape your financial stability and quality of life in retirement:

Quality of Life

After years of building wealth, retirement is the time to enjoy it. Quality of life might mean proximity to family, access to recreational activities like year-round golf, or living near cultural institutions and natural beauty. For many, maintaining a fulfilling lifestyle also means ensuring that retirement income, tax exposure, and investment portfolios are aligned with long-term goals.

Reflect on what matters most to you and assess which locations support the lifestyle you envision.

The Housing Market

For most HNWIs, housing represents a significant asset. When selecting a retirement location, evaluate both current property values and future market potential. A well-chosen home can contribute to portfolio diversification, capital appreciation, and wealth preservation.

Consider whether the area aligns with your financial strategy, particularly in relation to real estate trends and the long-term value of your investment.

Cost of Living

The cost of living varies widely across states, influencing how far your retirement income can go. Evaluating how your investment accounts, taxable income, and retirement funds perform in different economic environments can help you optimize your financial strategy.

For example, the Cost of Living Index shows that $100 in average goods and services might cost only $83 in Mississippi but up to $159 in Hawaii. Mississippi offers affordability but ranks lower on certain livability metrics, while Hawaii provides a high-end lifestyle at a premium cost.

Balancing these financial considerations with lifestyle preferences can help you determine the most practical and rewarding retirement location for your needs.

Taxes

For retirees—especially high-net-worth individuals—understanding the tax landscape is essential to long-term financial planning. State income tax, property tax, estate tax, and sales tax policies can significantly affect your retirement wealth strategy. Incorporating these variables into your broader retirement financial planning can result in substantial savings over time.

States with no or low state income tax may reduce your overall tax burden. For example, choosing to live in a state like Texas, which does not impose a personal income tax, can yield meaningful savings compared to a high-tax state like California, which taxes income up to 13.3%. For individuals with substantial investment or business income, this difference compounds significantly.

Currently, seven states do not levy a state income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Wyoming

However, low income tax rates may be offset by higher taxes in other areas. Texas, for instance, has an average effective property tax rate of approximately 1.9%, compared to California’s 0.72%. When evaluating tax efficiency, consider the full spectrum of taxation—income, property, estate, inheritance, and sales tax—rather than focusing on a single category.

Healthcare

The old adage “health is wealth” becomes especially relevant in retirement. Access to high-quality healthcare should be a key factor when selecting where to retire. As medical needs typically increase with age, living in a state with well-regarded healthcare systems and facilities can provide peace of mind.

States like Hawaii, Massachusetts, Connecticut, California, and New Jersey consistently rank high in healthcare quality, offering strong benchmarks for those prioritizing medical access. Additionally, exploring the benefits of a Health Savings Account (HSA) as part of your retirement strategy can help offset future healthcare costs in tax-advantaged ways.

Consider proximity to hospitals, specialists, and long-term care facilities, particularly if you anticipate needing ongoing or specialized care. These logistical and financial considerations can greatly influence both comfort and quality of life in retirement.

Weather

Climate plays a powerful role in lifestyle and well-being. Some retirees prefer the year-round warmth of states like Arizona or Florida, ideal for golf and outdoor leisure. Others may seek seasonal variation in states with four distinct seasons or locations that cater to skiing and winter recreation.

Deciding between a dry or humid climate, or choosing coastal versus inland living, can also impact health conditions, energy levels, and personal satisfaction. Climate should align with your comfort preferences and contribute positively to your quality of life.

Culture

Cultural fit is another important, yet often overlooked, component of retirement planning. Your hobbies, interests, dining preferences, and lifestyle aspirations may guide your choice of location. Whether you’re drawn to vibrant arts scenes, culinary hotspots, or a slower pace of life, different regions offer vastly different experiences.

Proximity to family and friends can also weigh heavily. While the lifestyle in Florida or Southern California may appeal, retirees with strong family ties in the Pacific Northwest or Northeast may prioritize staying connected over relocating.

Ultimately, the best retirement destination is one that balances financial strategy with your desired lifestyle. It should support your retirement income goals, healthcare needs, and personal well-being.

Stating Facts: The Best Places to Retire Rich

For high-net-worth individuals, states like Florida, New Hampshire, Alaska, Nevada, Texas, Wyoming, and Utah offer compelling retirement advantages. These locations combine favorable tax policies with appealing quality-of-life factors, helping retirees preserve wealth, minimize taxes, and enjoy a comfortable lifestyle.

Below are highlights of several retirement-friendly states for individuals with significant assets:

Florida

Florida continues to be a top retirement choice for HNWIs due to its lack of state income tax and overall retiree-friendly policies. With no taxes on retirement income and a relatively low cost of living compared to other coastal states, Florida helps extend the value of investment and retirement accounts.

Its year-round warm climate, beaches, and abundant outdoor recreation make it attractive for active retirees. The state also boasts a robust infrastructure tailored to seniors, including healthcare systems, cultural amenities, and retirement-focused communities.

New Hampshire

Known for its low overall tax burden, New Hampshire imposes no sales tax, no estate tax, and no tax on Social Security income. This structure supports long-term wealth preservation and estate planning goals for HNWIs.

The state offers strong healthcare access and picturesque settings for outdoor enthusiasts, from mountain ranges to lakes. While the cost of living is higher than average, many retirees consider it worthwhile given the financial trade-offs.

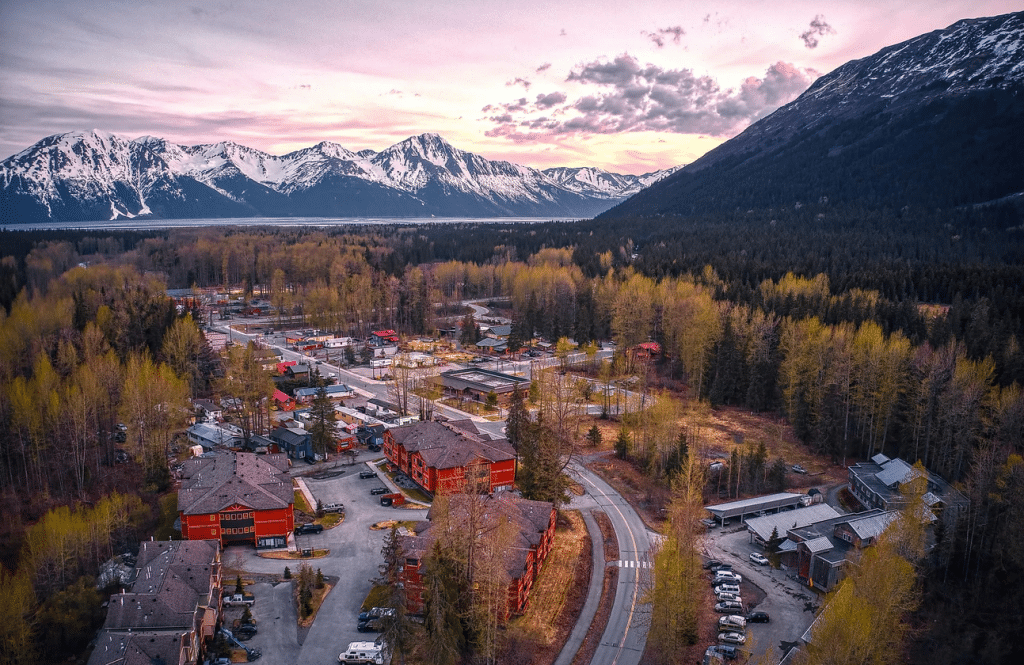

Alaska

Alaska appeals to retirees seeking low property taxes and no state income tax. These advantages, combined with unique natural beauty and opportunities for outdoor recreation, make it appealing for those prioritizing both financial efficiency and lifestyle.

However, Alaska’s remoteness and harsh winters may not suit everyone. It’s ideal for individuals who value solitude, self-sufficiency, and a deep connection to nature alongside financial prudence.

Nevada

Nevada’s lack of state income tax and relatively low cost of living have made it increasingly popular among retirees. The state offers tax efficiency, especially for those with high investment income or business interests.

With amenities in Las Vegas, outdoor opportunities in Lake Tahoe, and a climate that appeals to those avoiding humidity, Nevada balances financial benefits with an active and varied lifestyle.

Texas

Texas combines financial advantages with lifestyle diversity, making it a popular retirement destination for high-net-worth individuals. One of the state’s standout benefits is its lack of state income tax—an especially valuable feature in a state with a large population and broad economic base.

The state offers a wide range of living environments, from major cities like Houston and Dallas to more tranquil areas such as the Hill Country or the Gulf Coast. This geographic diversity allows retirees to select a setting that matches their lifestyle preferences—whether that means vibrant urban living or peaceful rural surroundings.

Texas is also known for its pro-business climate and relatively low cost of living. Its regulatory environment and stable economy appeal to business-minded retirees or those continuing entrepreneurial ventures. Whether you’re looking to preserve capital or invest in new opportunities, Texas offers a supportive financial and commercial ecosystem.

Wyoming

Wyoming offers a unique blend of natural beauty and financial efficiency, making it attractive to retirees who prioritize both outdoor living and low taxes. The state levies no personal income tax and maintains one of the lowest property tax rates in the country.

It’s also home to iconic destinations such as Yellowstone National Park, Grand Teton National Park, and Jackson Hole—ideal for those who enjoy hiking, skiing, or simply experiencing the outdoors. Despite its scenic appeal, Wyoming is the least populous U.S. state, giving retirees access to spacious surroundings and a quieter lifestyle.

For those seeking both simplicity and financial clarity, Wyoming offers a low-cost, low-tax environment with access to some of the nation’s most stunning natural landscapes.

Utah

Utah strikes a balance between scenic appeal, economic strength, and a tax structure that’s competitive yet not extreme. While the state does impose income tax, it offers moderate property and sales taxes, providing a well-rounded environment for high-net-worth retirees.

The state has experienced rapid population growth, driven in part by its expanding real estate market and reputation for quality of life. This growth presents potential opportunities for property appreciation, making Utah a compelling option for real estate investors.

Utah is also known for its outdoor lifestyle. It’s home to five renowned national parks—Zion, Bryce Canyon, Arches, Canyonlands, and Capitol Reef—offering endless opportunities for hiking, exploration, and year-round activity.

For retirees seeking a blend of fiscal responsibility and access to nature, Utah delivers a compelling mix of financial sustainability and lifestyle richness.

Relocating in Retirement Can Stretch Your Savings in Today’s Economy

Choosing where to live in retirement is a pivotal decision, especially for high-net-worth individuals, touching on lifestyle, healthcare access, and long-term financial stability. For those managing significant retirement income and investment portfolios, it’s often a question of balancing tax implications with quality of life to make the most of their retirement years.

Despite the potential benefits, most American retirees stay in place. Census Bureau data from 2015 to 2019 shows that only about 6.2% of individuals aged 65 and older moved annually, compared to 15% of the broader population. Still, the number of retirees choosing to relocate is slowly increasing, driven by changing priorities and evolving needs.

According to the American Planning Association, retirees who do move tend to be renters, individuals living alone, or those with lower incomes facing high housing costs. Common reasons include wanting to live closer to family, improving their neighborhood environment, or lowering their overall living expenses.

Karen B., a 64-year-old escrow mortgage professional from Southern California, has no plans to move in retirement. Despite California’s high cost of living and low retirement rankings, she cites her close family ties and the region’s favorable weather as reasons to stay. Her disciplined approach—minimizing expenses while maximizing 401(k) contributions—stands in contrast to the financial shortfalls many nearing retirement still face.

As affordability becomes a growing concern, some experts suggest considering more cost-effective regions, such as the Midwest and South, over the pricier Northeast and West. For retirees able to use home equity from a previous residence, relocating could allow for a mortgage-free lifestyle. Additionally, moving to areas with lower healthcare costs can offer significant financial relief in later years.

Personal finance expert Shang Saavedra recommends assessing your financial standing using retirement planning tools. Aligning your location with your financial reality can dramatically affect your quality of life, making relocation an important piece of the retirement financial planning puzzle.

Three Expert Tips for Retirement Planning

If you have a specific retirement destination in mind, it’s worth considering insights from professionals who specialize in retirement financial planning. These advisors provide informed perspectives on everything from financial preparedness and healthcare access to social and lifestyle transitions. With their experience, they can help you align your retirement vision with practical steps, addressing your unique needs and making the transition more manageable.

Here are three valuable tips from experts who guide individuals through the retirement planning process:

1. Account for Both Immediate and Long-Term Relocation Expenses

When evaluating a new location, it’s important to look beyond the surface appeal. The true cost of relocating includes not just immediate expenses, but also long-term financial sustainability. Consider the future cost of living, the economic stability of the area, and how well the location aligns with your overall retirement goals.

Think about how rising prices, shifting local economies, and your own evolving lifestyle may affect your finances years down the line. A well-researched decision can make the difference between a smooth transition and one that creates unforeseen burdens.

2. Temporarily Test Living in a New Area

Before committing to a permanent move, consider renting in your desired location for several months. This “trial run” gives you time to experience the community, build social connections, and see how well it fits your lifestyle. Whether it’s participating in local events, joining a fitness group, or volunteering, this phase can help you gauge whether the environment supports your social and recreational needs.

Rather than simply changing zip codes, you’re exploring how well the area fits your long-term lifestyle and values, laying a solid foundation for a confident move when the time comes.

3. Housing Savings Are Just One Piece of the Puzzle

While finding a more affordable home can support your finances, it’s just one element of a comprehensive retirement plan. Many retirees want to stay in familiar surroundings, but doing so requires planning for evolving health and mobility needs.

Evaluate whether your current or future home can adapt to changes in physical ability and care requirements. Consider factors like single-level layouts, low-maintenance features, and proximity to healthcare. A home that meets both current and future needs can preserve your independence and improve your quality of life as you age.

Retirement financial planning isn’t just about dollars and cents—it’s about designing a living environment that evolves with you and supports long-term well-being.

Choosing the Place to Spend Your Retirement: Are You Finally Ready to Decide?

Selecting where to spend your retirement is a major life decision—one that can significantly shape your financial outlook, lifestyle satisfaction, and long-term well-being. Retirement financial planning plays a key role here, particularly when it comes to managing investment portfolios, taxable income, and overall tax liabilities. Ensuring that your preferred state aligns with your broader retirement strategy is critical to building a stable and fulfilling future.

Reveal Your Vision

This process begins with identifying the lifestyle that best suits your retirement years. Do you envision yourself in a vibrant city with cultural experiences and an active social circle? Or are you drawn to a peaceful coastal setting, with nature trails and space to unwind?

Clarifying your priorities will help determine which retirement destinations best reflect your personal goals. Even if returning to your hometown feels familiar, it’s worth exploring other areas that may offer a better fit. Leverage digital tools for virtual walkthroughs, and, when possible, visit promising locations in person. Speaking with locals and other retirees can offer firsthand perspectives on day-to-day living in each community.

Seeking Expert Guidance

Working with experienced professionals can help refine your decision. A retirement financial planner can evaluate whether your preferred state supports your financial goals, from income sustainability to estate planning and wealth preservation. Relocation advisors may assist with the logistics, helping assess housing availability, access to healthcare, and broader quality-of-life considerations.

When guided by thoughtful research and planning, and supported by professionals familiar with high-net-worth retirement strategies, choosing where to retire becomes more than a financial decision—it becomes a well-crafted step into your next chapter.

To take the next step with confidence, explore the tools and resources that can support your retirement goals:

Is Retiring in the US Better Than Abroad?

For some retirees, living abroad can reduce expenses—thanks to lower living costs and, in some cases, more favorable tax environments. However, retiring within the United States offers familiarity, continuity within established systems, and the ability to remain close to family and support networks. It also reduces the challenges that can come with international healthcare, banking, and legal systems.

Can Retirees Immigrate to the United States?

The U.S. offers certain pathways for individuals wishing to retire long-term within its borders. While there is no specific “retirement visa,” some retirees gain permanent residency through family sponsorship, investment-based visas, or other qualifying categories. With permanent residency (green card status), individuals may apply for U.S. citizenship after five years, assuming they meet eligibility requirements. Contributions to U.S. systems—such as Social Security—can also factor into residency considerations for those who have worked in the country previously.

Where Do High-Net-Worth Individuals in the U.S. Often Retire?

Some of the most popular states for affluent retirees include New York, New Jersey, Vermont, Massachusetts, Maryland, and California. These areas are known for their access to high-end amenities, cultural attractions, and quality healthcare. While they tend to rank among the more expensive retirement destinations, they appeal to individuals who prioritize lifestyle quality and urban or coastal living over cost savings.

What Is Considered a High-Net-Worth Individual Account?

In financial terms, a high-net-worth individual (HNWI) in the U.S. typically refers to someone with at least $500,000 in liquid investable assets. Some firms use different thresholds depending on services offered, with classifications such as very high net worth (VHNW) or ultra-high net worth (UHNW) applying to individuals with significantly greater asset levels.

How Many Americans Have $1 Million or More Outside of Their Jobs?

Recent data suggests that about one in ten Americans has accumulated $1 million or more in assets, not including income from employment. This reflects the power of long-term investing, disciplined savings, and thoughtful retirement financial planning. For those looking to join that group, working with an experienced retirement planner may provide valuable strategies to build and preserve wealth efficiently.